Description

VUZI is a short because:

- Vuzix is not a real player in the Augmented Reality / Virtual Reality (AR/VR) industry and its core product is just a tablet on your face. Vuzix is not a leader in this competitive, low margin hardware market and has been losing share.

- Vuzix was a covid beneficiary as companies explored hands free remote assist options, but sales growth is poised to turn into sales declines which has just started.

- Vuzix has a promotional management team and a fickle, albeit dangerous, investor base (retail plus ARK). As numbers decline, larger players enter the AR/VR space (Apple), and private players go public exposing Vuzix as a weak player in the ecosystem, VUZI should revert from 50x sales back to a more normalized 5x sales which is a $3.30 target, down 75%.

VUZI is new to VIC but not new to short sellers. The company is up 6.5x from the start of 2020 due to another AR/VR hype cycle, Cathie Wood’s involvement starting in early 2021 (podcast with VUZI CEO), and strong sales growth in 2020 and 2021. I’ll give a brief overview of the company, the previous short allegations, and why I believe VUZI is actionable now.

Background

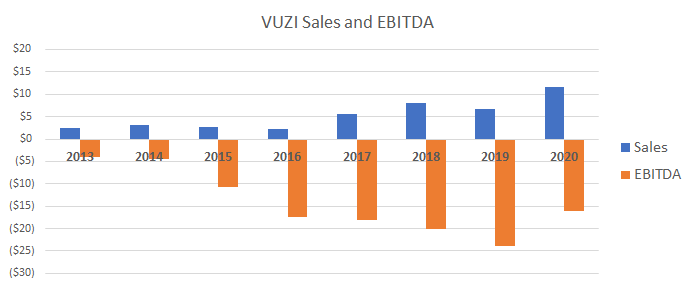

Vuzix is a smart glasses company founded outside Rochester, NY in 1997. The company went public in 2009 and uplisted to the Nasdaq in 2015 and has about 110 employees. The company has an extensive history of overpromising and underdelivering on customer wins, futures sales, and technology capability. Sales have barely grown prior to 2020 and the company has racked up extensive losses. These have been funded by stock offerings from retail hype cycles around the always inevitable AR/VR boom.

For additional color, please see the latest 10K and investor presentation.

Previous short reports

VUZI was written up by Mox Reports in March 2018 and then again by The Bear Cave in March 2021. Quick summaries:

Mox Reports: VUZI is a stock promote with undifferentiated and unproven products. The company has ties to fraudulent stock promoters, publishes news articles that are really paid advertisements, and puts out extremely misleading press releases around customer wins; example $5mm Toshiba win.

Bear Cave: VUZI’s history includes consistent unprofitability, serial dilution (shares up from 15mm in 2015 to 65mm today), suing short sellers, a 75-1 reverse split, 591 press releases, and in general more bark than bite. In Nov19 the company announced a $7.1mm order from a company run by a criminal in South Africa and Bear Cave is skeptical that any of those sales actually happened. Intel invested $25mm in the company in 2015, halted the partnership in 2016 and sold down its stake, then sold the remainder of its preferred stock in Jan21.

While these short reports highlight Vuzix’s questionable behavior, my analysis focuses on Vuzix’s market fundamentals and why the recent surge in sales will prove unsustainable.

Undifferentiated product

Vuzix’s core products are not “smart”. Augmented Reality is the dream, but VUZI is in the business of selling simple head mounted displays. This is like a connected tablet in your face. Sales of Vuzix’s lower-tech M-Series are ~90% of product sales. Meanwhile, sales of Vuzix’s AR-like product, Blade (introduced in 2018), are just ~10% of sales. The Blade is growing slower than the M-Series and is <$1mm annualized sales.

VUZI has little IP and is primarily a component assembler. Essential components are purchased by suppliers (example micro displays come from Sony and Texas Instruments) or made by third-party manufacturers. Vuzix often integrates newer technologies from companies like Kopin or JBD which provide the R&D engine behind a lot of the hardware competitors. VUZI’s R&D spend declined in 2019 and again in 2020.

Vuzix touts its portfolio of over 200 patents, but ex-employees and industry participants are unaware of any patents that are valuable or have ever restricted competitors from product development. These contacts are skeptical Vuzix would have any strategic IP value to an acquirer, which is a significant leg of the retail bull case.

Vuzix will struggle to achieve enterprise level AR because of the significant challenges of software and hardware integration. Each enterprise AR use case is extremely customized and would require a significant developer budget. Vuzix outsources this development work to either its customers or its value added resellers (VAR).

Hyper competitive industry; Vuzix not a leader

Vuzix’s smart glass competitors include some of the biggest and best - Microsoft, Sony, Google, Facebook, Lenovo, HTC, etc. and industry sources suggest Apple will be entering the category by 2023. Vuzix does not compete in the AR space and is more focused on the wearable display market.

The closest direct competitor is Realwear. Realwear has a similar form factor and is focused on the same enterprise customers in the same industries (industrial, commercial, security, medical, etc). Realwear’s sales are multiples larger than Vuzix, but the company’s private market value is a fraction of VUZI. Industry contacts highlight that Realwear has superior products vs. VUZI because of ease of use (camera not attached to screen so can move separately), durability, better voice dictation, better noise cancelling, better battery life, and more.

Vuzix’s strongest market segment is in the virtual assisted surgery space. Vuzix’s M-series product is lighter than competition and the headset can be easier to wear in conjunction with other headgear that doctors have to wear. The company loves to play up this category and VUZI has put out over 15 press releases in 2021 highlighting the virtual surgery / telemedicine space.

Vuzix might have a competitive product for this segment currently, but industry contacts highlight that they are not the leader and are likely to lose long term. Competitors have plans to adapt their headgear to be more comfortable for doctors and new competitors specifically targeting this niche are ramping up. Kopin highlighted how their recent growth was driven partly by a surgery headset startup in SanDiego that is co-funded by a large med device company. Vuzix highlights Medtronic as a marquee customer, but Medtronic uses just as much Realwear and is experimenting with other hardware vendors as well.

Covid beneficiary unwind

Vuzix management downplays the significance of their covid benefit and highlights how the company is a reopening beneficiary. Industry participants say the exact opposite. Covid was a tailwind as enterprises across almost all verticals looked for hands free remote assistance technology and rapidly deployed whatever was available. Remote field support, manufacturing and repair assistance, warehouse logistics, telemedicine, you name it. Companies are now revisiting those decisions and evaluating solutions more methodically.

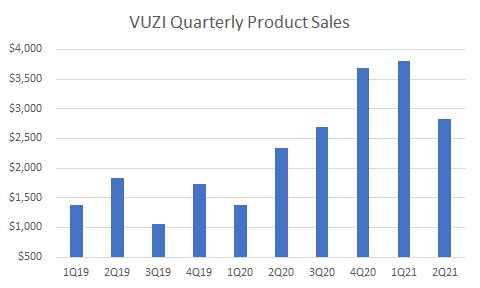

On 5/10/21 VUZI said that “we are well-positioned to continue to achieve significant year-over-year comparative revenue growth throughout the balance of 2021”. Just three months later on 8/9/21 Vuzix missed consensus sales estimates for 2Q21 by 33% and reported sales down 4% YoY and product sales down 26% sequentially.

Vuzix removed year over year growth language and instead guided to sequential growth. 3Q sales estimates were for $5.9mm and the company guided to $3-4mm on the call - a 40% miss vs expectations. This guidance could prove aggressive given 1) current industry trends, 2) management's historical aggressive guides (see below) and 3) commentary suggesting 2Q had one-time benefits.

Over promise and under deliver

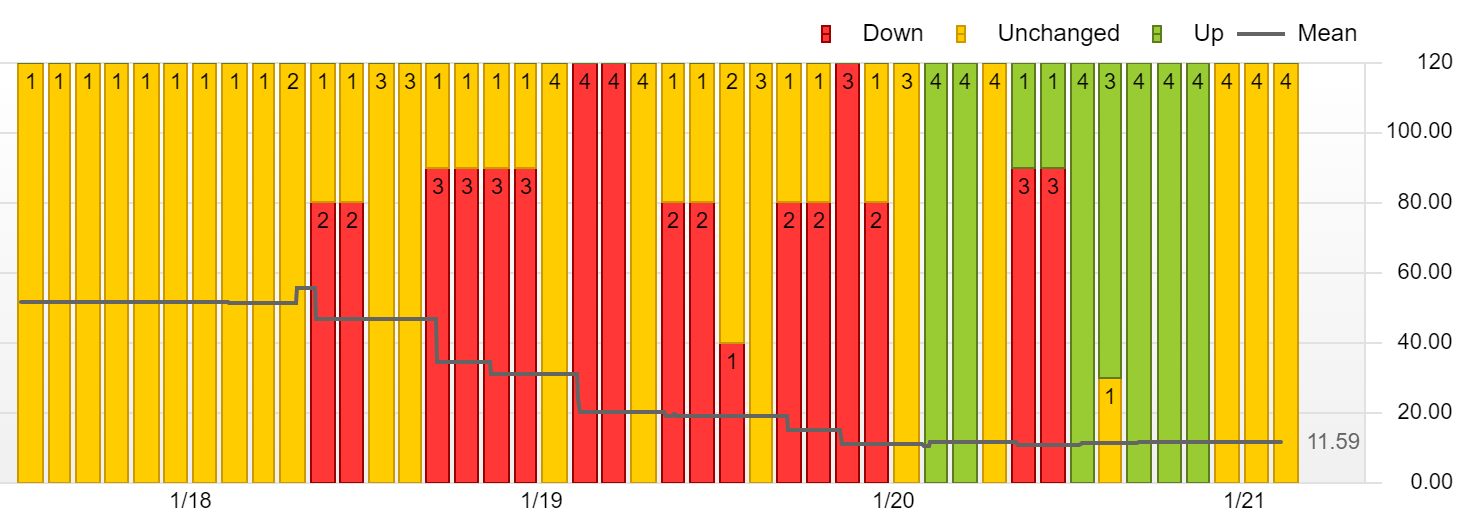

Vuzix has missed sales estimates 70% of the past 20 quarters. The stock has only gone up on one earnings day.

The charts below highlight VUZI’s ever declining forward estimates. 2019 sales declined from $70mm to a final reported $6.7mm in 2 years. 2020 sales declined from $55mm to $11.6mm. And you can see the trend in forward estimates while the stock increased 6.5x. This is the trend for VUZI every year.

Valuation and target price

At $13.20, VUZI has an $860mm market cap and $725mm EV. That’s 50x LTM sales for an unprofitable commoditized hardware vendor with 20% gross margins and declining sales.

At 5x $15mm of sales, which is VUZI's average historical multiple, VUZI is a $3.30 stock. This is down 75% and includes includes $2.10 of cash.

Conclusion

Vuzix is not a real player in the AR/VR industry and is riding high on unsustainable sales growth in their commoditized and competitive industry niche. Vuzix is losing share to competitors like Realwear and sales are set to decline as the covid tailwinds turn to headwinds. In addition, investors interested in AR/VR may soon have more credible investment options. VUZI has 75% downside to my $3.30 target price.

Risks

- Vuzix makes accretive acquisitions (strategic or financial) with its $137mm war chest.

- ARK continues buying and re-stimulates interest. They purchased ~1mm shares and were 10% of the volume when VUZI missed and lowered by 40%.

- WSB decides to play hot potato with VUZI

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

Catalyst

Earnings misses

Shitco factor declines

Competitors go public via IPO or SPAC