Description

This will be a brief write-up on a short thesis on Viacom Class A shares in respect to the rumored merger with CBS.

We believe that Viacom Class A shares (VIA) are an attractive short position with +20% return to an estimated deal price from CBS within 3 months. The key aspects of our thesis are:

-

Viacom A shares are trading at an undeserved 28% premium to the more liquid Viacom B shares (VIAB)

-

The CBS / Viacom merger

-

The Redstone family is forcing an ill-advised merger of CBS and Viacom through their voting control

-

CBS shareholders should (and seemingly do) hate this deal and will likely not support any premium paid for Viacom

-

Viacom shareholders will take anything they can get

-

Everyone will object to the Redstone family getting a premium for their Class A shares

-

The spread between Class A and Class B shares likely closes

-

Viacom A and B are both shorts if there is no merger

We won’t spend too much time talking about the industry and the respective businesses given how much traditional media has been discussed on this site, but we would point to all of the detailed prior write-ups on Viacom, Netflix, HBO, CBS and others on this site for background on the industry.

Thesis Points:

1. Viacom Class A undeserved premium

Since the split of CBS and Viacom back in 2005, the Viacom Class A voting shares have traded at a modest premium to the Class B non-voting shares, averaging 6%. While it has occasionally spiked up, it has generally been a modest premium.

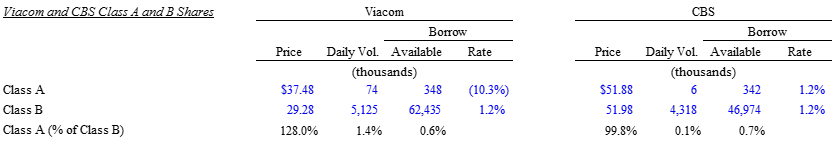

The premium is not really related to liquidity because the CBS Class A / Class B liquidity disparity is greater, but the CBS Class A shares trade in virtual parity with the CBS Class B shares:

2. The CBS / Viacom merger

While everyone will have their own views on the daily rumor mill of the CBS/Viacom merger, our views are:

-

The Redstone family is forcing an ill-advised merger of CBS and Viacom through their voting control:

-

Our view is that this merger is awful for CBS. CBS faces some of the same challenges as all traditional media companies but its asset portfolio is actually pretty decent with must-have broadcast TV, well-positioned premium cable channels and an ambitious OTT / streaming strategy. Viacom is a mess. The cable networks are the least well positioned, the balance sheet is stretched and Paramount Pictures perpetually loses money.

-

CBS shareholders should (and seemingly do) hate this deal and will likely not support any premium paid for Viacom

-

For that reason, CBS’ stock is down 20% since news of the merger broke out (and why we think you are seeing a relief rally today on the news that CBS was to pay a price under the current market price for Viacom)

https://www.reuters.com/article/us-viacom-m-a-cbs-exclusive/exclusive-cbs-plans-all-stock-bid-for-viacom-below-current-valuation-sources-idUSKCN1H91UE

-

Viacom shareholders will take anything they can get

-

In our view, Viacom’s share are being supported only by the merger speculation at this point

-

Everyone will object to the Redstone family getting a premium for their Class A shares

-

Given that no one will be happy here: CBS shareholder will hate being forced into this deal to begin with and Viacom shareholders will be upset with a take-under or no-premium deal, we think that it is extremely unlikely for the Redstone family to receive a premium for their Class A shares above what Class B shareholders receive

-

To illustrate, we can look at the aggregate market values of the Redstone family holdings in both Viacom and CBS and compare those to the non-Redstone family holdings.

-

The Redstone family owns $2.0 billion of CBS stock which they are using to force a merger with their $1.5 billion Viacom holdings

-

Non-Redstone shareholders who own $18 billion of CBS are the ones who are subsidizing the merger and diluting their asset quality and balance sheet

-

Non-Redstone shareholders who own $11 billion of Viacom are likely to receive no premium

-

In this scenario, we think it would be egregious (though not unprecedented) for the Redstone family to seek a premium for their Class A shares

-

Therefore, we think the spread between Class A and Class B shares likely closes

3. Viacom A and B are both shorts if there is no merger

If there is no merger, then both Viacom A and B go down and over time we think the Class A premium narrows back to its historical 6% figure over time. The 10% borrow cost is a nuisance but we think you still make money on the short and we believe that the borrow cost actually recedes relatively soon.

4. Expected Return

You can use your own assumptions on what CBS pays for Viacom but given the news last night that CBS was considering a price under the current market price for VIAB, we believe a premium is unlikely:

Additional Topics to be discussed in Q&A

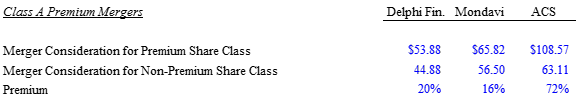

Historical mergers where Class A shareholders were paid a premium and why those are different than Viacom/CBS (the buyer and seller were unaffiliated, the buyer really wanted the assets unlike CBS, the seller was not willing to sell unless they received a voting control premium, there was often litigation from Class B shareholders, but big premiums do occur):

The author of this post or the firm he is affiliated with may have a long or short position in the stock which is the subject of this post and may change his views or position at any time and has no obligation to update this post in any such case

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

Catalyst

CBS merger with either no premium or below current market prices for VIA/VIAB

No merger and continued deterioration in Viacom's standalone business