Description

NEMAK (Price Target $ 12.5 MXN)

COMPANY OVERVIEW

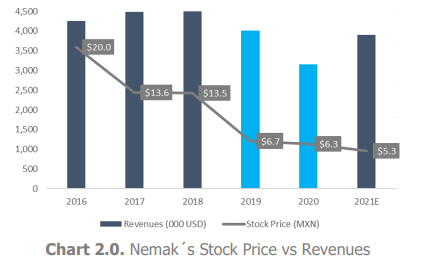

Nemak is a leading provider of innovative light-weighting products for the global automotive industry for developing and manufacturing powertrain components, battery housings for PHEV and body structure applications.

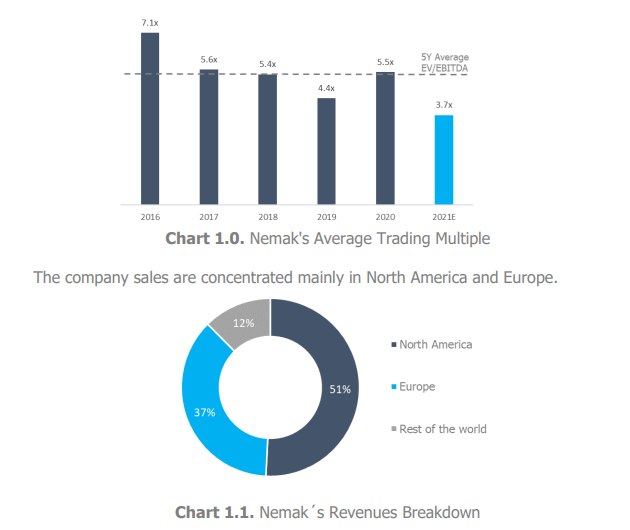

Listed on the Mexican Stock Exchange Market (BMV), Nemak (NEMAKA.MX) has a Market Capitalization of 1.1 billion USD and generates over 3.9 billion USD in annual revenues. The company is currently trading at 3.7 EV/EBITDA with a market discount of 33% against its last 5Y trading average of 5.6x, making it a deep value investing opportunity.

Nemak operates through a high-value diversified portfolio, which is the #1 in the production of cylinders and engines with a market share of 26% and 18%, respectively, and the #3 for transmission components. For the SC&EV segment, Nemak's objective is to have a leading position with a 25% market share in North America and Europe; currently, Nemak's market share is around 20%. The company has the largest variety of casting production processes that enables the company to maintain its portfolio competitiveness.

NEMAK SUFFERED A SEQUENTIAL OF NEGATIVE IMPACTS

Since 2019, Nemak's stock price has lost almost 65% of its value. This notable decline was because Nemak's principal clients lost more than 15% of its market share (Ford, GM, and FCA); engine downsizing from some clients; and investors underestimated Nemak's lack of capacity to change into new business trends.

Then, the Covid-19 imposes new challenges into the automotive industry. The first one is the economic impacts generated by the pandemic lockdowns. The second one, supply chains have been under pressure, affecting mainly OEM's companies. And the last one, the pandemic exponentially accelerated a trend that has been coming since the previous years “the electric vehicle era”.

The before mentioned could sound like series of tragic events for the company. Moreover, every risk can be transformed into an opportunity that will be explained further.

NEMAK IS A RESILIENT COMPANY WITH STRONG FUNDAMENTALS

Regarding the Covid-19, auto parts and equipment companies suffered enormous consequences, navigating into a challenging economic environment. Moreover, Nemak's strong balance sheet positions the company to support and navigate through prolonged periods of production stoppages and lower demand. Almost all OEMs have a strong cash position (Something they learned from the 2008 crisis).

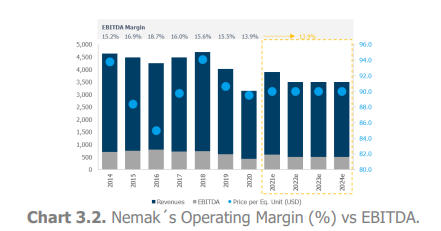

According to the supply constraints, Nemak has shown the ability to reduce its operating expense and improve its margins.

Additionally, Nemak has a particular capacity to optimize its CAPEX in periods of economic stress.

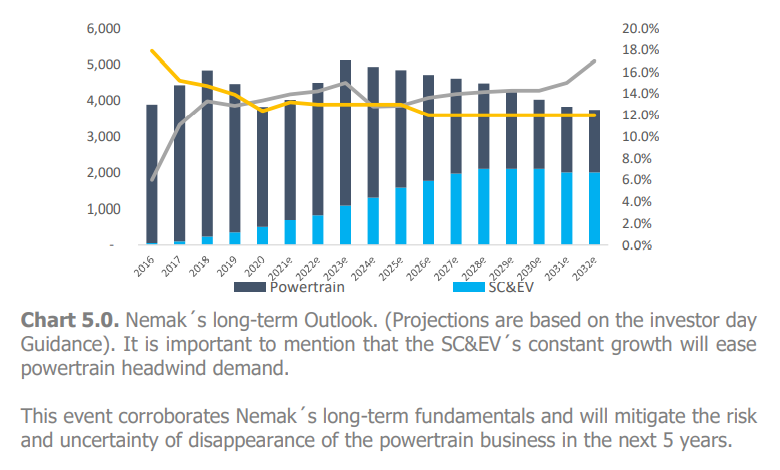

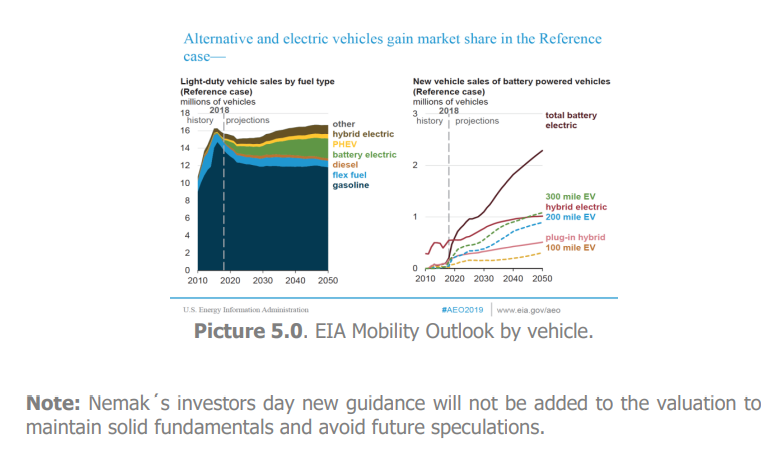

Investors thought that the Electric Vehicle Era represented an enormous risk for the company and hit its fossil motors' volume components. Instead of that, Nemak transformed this into an opportunity for the SC&EV segment. The segment will provide the necessary components for the new electric cars and give further market penetration to the company, along with the compensation for the lost volume in fossil fuel cars. In 2019, the segment only accounted for 4% of total consolidated sales. In 2025, the company establishes an objective to achieve a 38% of total revenues.

Nemak has the capacity to adapt to new market trends. Also, the company is a step ahead of its peers in the manufacture of EV components.

POTENTIAL CATALYSTS

EVs will continue to gain market share. Also, Nemak has a strong position for housing batteries, accounting for a 20% of the market share.

Nemak strategy is to manufacture high value-added products made of Aluminum. EVs components will require more aluminum because it is a versatile metal that allows more efficiency to the vehicle. The principal properties are the lightweight and the CO2 reductions per ton manufactured. It is important to mention that aluminum prices have been at their highs since 2014 due to the extensive demand for feedstock for various products. The increase in the commodity price is transferred to the final clients, avoiding a margin pressure problem for the company.

Nemak´s clients, like Volkswagen, are winning more market share in the electric vehicles, securing more future sales agreements for the company.

Around different countries, the Covid-19 crisis reduced the government spending in the renewable sector as for the EVs subsidies, prolonging Fossil fuel vehicles life. This effect will extend a lower decline for fossil engines volumes.

At current valuation, Nemak has a considerable market discount, basically at liquidity value, giving a substantial safety margin to the investor.

NEMAK VALUATION

Nemak Valuation – The SC&EV business unit was valued with DFC, considering a WACC of 9% and perpetual growth of 0%. The future FCF projections were based on the closed contracts. Then, the powertrain segment residual value is added. The Powertrain segment is considered that will disappear, and its residual value is based on a yearly decline rate.

Relevant Considerations:

· The SC&EV potential upside could be exponential. However, to give more certainty on the cash flows it was only valued with the already gained contracts to remain constant over the future.

· The current valuation does not considered any additional gain or loss for future potential contracts. If the company continues signing new order books, then the valuation should be positively updated.

MAIN RISKS

Most of the identified risks represent short-term concerns for the company, such as:

· The semiconductor shortage brought a higher impact for Nemak in the first half of the year (4.5 million vehicles were affected due to the semiconductor shortage, and for NEMAK, this represented 1 million equivalent units). It is expected that the company will be at pre-pandemic levels having the shortage as a minimum consequence for the final of the year.

· The company' s ability to secure more EVs contracts.

· A faster fossil fuel vehicles decline could affect Nemak ´s revenues growth.

The three remarkable risks that could affect the company's future long-term performance are:

- Nemak's clients could continue to lose potential market share.

- Engine downsizing from some Nemak's clients.

- Since 2015, the diesel share in Europe has declined by 20%. Diesel applications represent 10% of Nemak's consolidated revenues

FINAL CONSIDERATIONS

With all the above mentioned, we conclude that Nemak is a strong value opportunity for the following years, and a big play for the electric vehicle era. The company revenues are forecast to grow with a CAGR of 11% during the next three years, maintaining competitive margins with a strong balance sheet position. Once Nemak capitalizes its gained contracts, it is estimated to have double-digit profitability indicators for 2023E with a ROIC of 10% and a ROCE of 11%. The company is trading at a very attractive position with a safety margin in case of adverse impacts. The aforementioned is reflected on Nemak's attractive valuation, with a price target of $12.5 MXN, with a potential upside of 135%.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

Catalyst

EVs will continue to gain market share. Also, Nemak has a strong position for housing batteries, accounting for a 20% of the market share. Earnings results.