Lubys should easily go up 50% this year. Since my write up on Feb 3 2015, Lubys stock price has not moved. During the same amount of time, the CEO Chris Pappas and Director Harris Pappas have bought 789,961 shares for $3,967,952 at an average price of $5.02 per share.

The bright side is the most recent conference call of Lubys discussing Q1 FY2016 results. It is one of the most positive conference call Lubys has had in a long while.

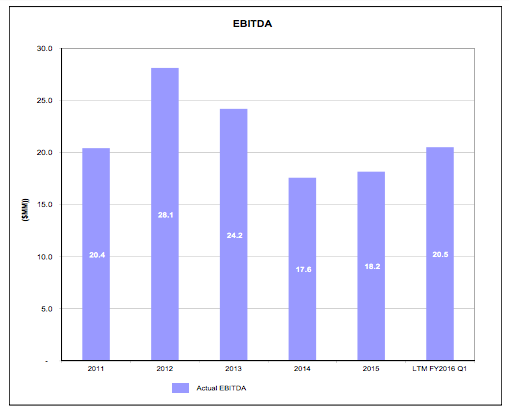

Lubys reported Q1 FY2016 numbers that were substantially better than Q1 FY2015. Ebitda was 5.7MM versus 3.3MM last year or a 73% increase. The company is on track to do 34 million in EBITDA this FY2016.

The cost-cutting indicate that the company is operating at a lower fixed cost structure. Any increase in the revenues should contribute meaningfully to the bottom line. Moreover, , the initiatives to train leadership development of employees could be long term improvements that should go past FY2016. Barring a big recession, Lubys stock can easily double from here. The value of the company is supported by the huge amount of real estate that they own. The debt can be paid off by selling just 6 of their combo concept real estate locations.

Chris Pappas, the CEO who has been buying shares over the last year, said in the conference call, that “ Continuing our current momentum throughout 2016, we expect to generate positive net income in the second half of the year.”

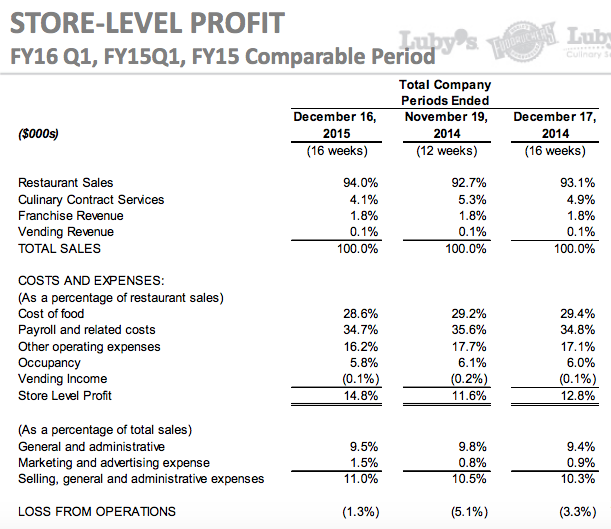

“Total Company sales for the quarter increased $1.3 million to $120.7 million over last year, primarily driven by a $2.4 million increase in restaurant sales due to increased same-store sales and new unit sales offset by a decline in culinary contract service revenue of $1 million. Store level profit was $16.8 million in the first quarter or 14.8% of restaurant sales, up from 12.8% last year and up sequentially from 14.2% last quarter. Lower cost as a percentage of restaurant sales in all store level cost categories contributed to our improved store level profitability in the quarter.”

“The positive sales momentum, combined with store level operating -- lower store level operating expenses and reduced costs associated with opening stores all led to the $2.4 million increase in EBITDA that Chris previously discussed. The improvement in EBITDA represents a 70% increase over the comparable 16 weeks from the prior year. The significant increase in EBITDA occurred despite some significant investments in marketing and advertising in the quarter.”

“In fiscal 2016, we're focused on continuing to improve cash flows and EBITDA. Our team and I are not pleased with how the market is currently valuing the Company as evidenced by the stock price, but I am confident that in the direction and initiatives being executed by all of our teams that those are the keys to growing EBITDA to increase our shareholder value.”

Valuation: Little back of the envelope analysis here:

2016 EBITDA $33 million

Maintenance Capex of $8 million

10 times EBITDA less Mtc Capex equates to $250MM Enterprise Value

With $35MM of debt, this is equivalent to $215MM market cap or $7.45 per share, a 50% upside from here.

This does not include the amount of real estate that they own.

Just to introduce the story to new readers, here are a few quick facts about Lubys:

-

Trade on NYSE since 1982

-

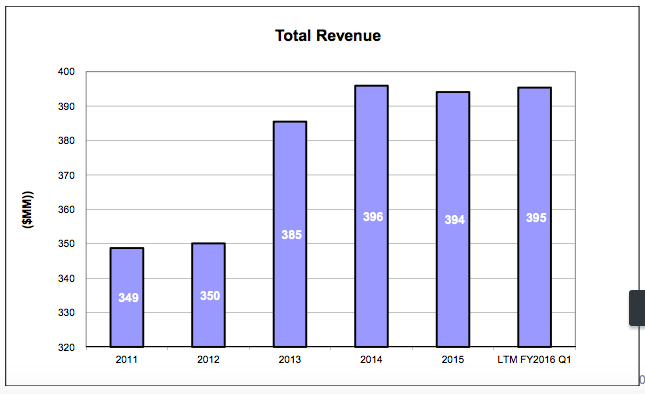

Approximately $400M in Annual Revenues

-

System‐wide sales $540M (including Fuddruckers Franchises)

-

FY2016 Q1 Trailing EBITDA of $20.5M

-

Operate primarily 93 Luby’s Cafeterias, 77 Fuddruckers restaurants, and 8 Cheeseburger in Paradise Restaurants

-

Operated Luby’s Cafeterias for 68+ years, Fuddruckers for 5+ Years, and Cheeseburger in Paradise over 2 years

-

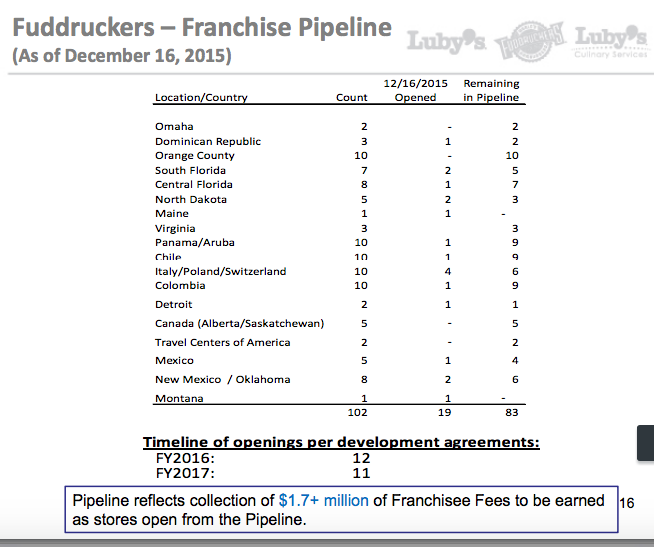

Support 111 Fuddruckers franchises across the United States, Canada, Mexico, Dominican Republic, Italy, Panama, Chile, Poland, and Colombia Providing Contract Culinary Services at 28 locations

Products (Brands):

Luby’s Cafeterias was founded in 1947 in San Antonio, TX with a mission to be the most successful cafeteria company in America. By serving customers convenient, great‐tasting, home‐style meals at an excellent value in a friendly environment.

Fuddruckers has been delivering uncompromised quality and in‐your‐face freshness while inspiring guests to build their own World’s Greatest Hamburger ® since 1980. Fuddruckers Hamburgers is known for its lively atmosphere, premium‐cut, grilled‐to‐order beef, scratch‐ made buns and market fresh produce.

Cheeseburger in Paradise offers a laid back beach party atmosphere where guests can leave the stress of everyday life behind and enjoy an ice cold beverage. A place where the food is awesome, the cocktails are hand crafted and you can enjoy a one‐of‐a‐ kind Kicked Back Vibe.

Luby’s Culinary Services launched in 2006 with a mission to redefine the food contract service industry. To be the best, not necessarily the biggest, is the daily mantra across this growing brand that is designed to serve the corporate, hospital and higher education market.

Management:

Chris Pappas – President, CEO, Director of Luby’s Inc. since March 2001 – More than 39 years of experience in restaurant industry

Peter Tropoli – COO since 2011; General Counsel and SVP Administration since 2001 – 18 Years in restaurant industry

Scott Gray, CPA – SVP and CFO since 2007; Finance and audit roles at Luby’s since 2001 – 19 Years in restaurant industry

Todd Coutee – SVP Operations since 2011 – 25 Years in restaurant industry, including 12 years in contract services

�

Store-level profitability for Q4 2015 reached 14.8% from 11.6% and 12.8% in the 2 years before.

�

Q1 FY2016 also marked the greatest number of Fuddruckers franchisee openings in a single quarter since Lubys acquired the Fuddruckers brand in 2010, which means a nice increase in high-quality royalty income for Lubys.

Last year, mitc567 thought Fuddruckers royalty income is shrinking and in long-term decline. This year’s growth in franchisees is a positive development.

�

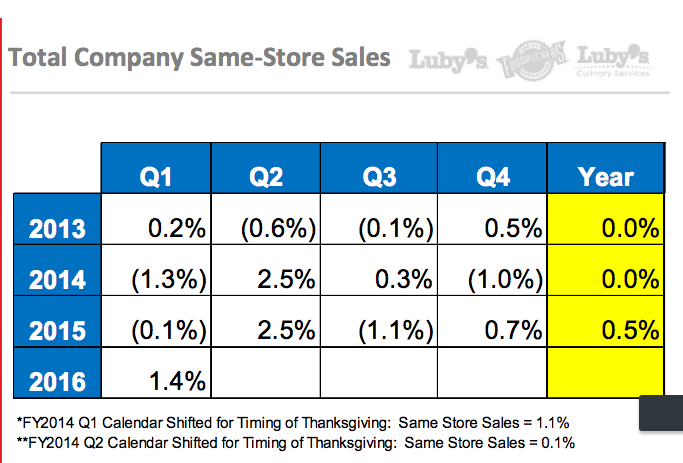

Company same-store sales for Q1 FY2016 bode well for the rest of the year as company’s Q1 historically has not been good for the last 3 years. Last year, mitc567 reasonably stated that he thinks Luby’s could not be turned around even by the great operators like the Pappas. While not a lot, this last quarter’s increase in same-store sales is at least encouraging.

�

EBITDA of $33MM looks achievable, even by historical standards.

Total Revenue of > $400MM is also quite achievable, by historical standards.