I recommend a long position in the preferred shares of Freddie Mac (FRE). Some tickers include FMCKP, FMCKI, FMCCL, and FMCCH. You can find the full list of preferred tickers here: http://www.freddiemac.com/investors/preferred_stock.html There is $14b of preferred stock outstanding at par.

The various series of FRE prefs increased from ~6% to ~9% of par after FRE reported a profitable Q1 2011, but the opportunity still exists to make an up to a 10x return over the next 4 to 5 years as FRE earns its way out of the Treasury senior preferred hole.

In addition, I believe the political situation will change for the better once FRE starts to pay back the Treasury. FRE and FMN are the last remaining bailouts that have not been resolved. I imagine there would be an election year temptation to wrap up all the bailouts and declare victory. The FT reported earlier this year that FRE/FMN approached Treasury seeking to reduce the onerous 10% senior preferred coupon. FRE is currently paying $1.6b/quarter in dividends to Treasury. A reduction in the coupon would be a major catalyst.

There are two parts to the FRE model: 1) The amount of pre-tax, pre-provision, post-Treasury coupon income (PPPTI); and 2) total credit losses.

PPPTI

I purchased the $50 par FRE prefs in 2009/ 2010. People usually look at me like I have an alien brain slug attached to my head when I mention this to them. Obviously, FRE is hopelessly insolvent, except that it's not. FRE has earned $38.5 billion in net interest income since Q1 2009. That's a lot of earnings power to fill in a capital hole.

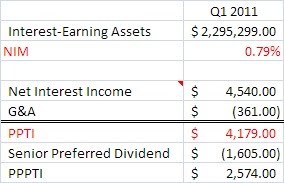

Here is what FRE did in Q1 2011:

FRE generated $2.6b of PPPTI in Q1 or $10.5b annualized.

Total Credit Losses

So FRE can generate about $10b of capital annually even with the bloodsucking Treasury coupon. Now let's figure the size of FRE's capital hole. The Q1 2011 balance sheet shows book value of $1.2 billion with $64.7b of Treasury senior preferred. FRE also has $39.3b of loss provisions. Thus, we need to figure out if the $39.3b is adequate to cover the eventual total losses of FRE's mortgage portfolio.

Loss estimate table as a Google spreadsheet:

https://spreadsheets.google.com/spreadsheet/pub?hl=en&hl=en&key=0AqXYysw53uW5dE8zbVhVaUVHOGZ4eXdRckZndC1GSFE&output=html

To estimate eventual total losses, we need to estimate two things: 1) the cumulative default rate (CDR); and 2) loss severity (i.e., how much does FRE lose of unpaid principal balance (UPB) in the event of default).

As you can see in the table above, at Q1 2011 FRE held $1.8 trillion of unpaid principal balance. The very bad vintages are obviously 2005, 06, 07, and 08. The CDR column is the percentage of that vintage that has defaulted to date in basis points. The first estimate is the final CDR. The CDRs for 2006 and 2007 are still going vertical, but I am hopeful that they will flatten out given recent credit trends and natural portfolio aging.

For example, from the recent 10Q: "The number of new serious delinquencies (i.e., seriously delinquent loan additions) declined in each of the last five quarters; however, our single-family credit guarantee portfolio continued to experience a high level of serious delinquencies and foreclosures in the first quarter of 2011 as compared to periods before 2009." Charge-offs also appear to have peaked in 1H 2010.

I freely admit I could be optimistic about 2006 and 2007. The other optimistic assumption I make is that the 2008 vintage ends up looking like 2005 rather than 2006 or 2007. However, 2008's CDR is thus far tracking like 2006.

The difference between the final CDR and the existing CDR is the remaining defaults to come. For those defaults, we need to estimate a severity. You can see my estimates. The total severity rate for the portfolio works out to be 30%, which is lower than the ~40% severity rate over the past 5 quarters. I expect the severity rate to decrease as the ugly bubble vintages work their way out of the default pipeline.

With my estimates, I get to a final total loss number of $46 billion, compared to FRE's $39.6 billion loss provision. If I'm right, FRE is near the end of its loss provisioning.

Let's use the $46b total lost estimate to calculate an "adjusted book value", or the hole FRE must earn itself out of.

Adjusted book value = Book Value - Gov't Preferred - Additional Provisions, or a $70b hole.

Filling in the Hole

$70b hole/$10b annual PPPTI = 7 years for FRE to account for all credit losses and pay back the Treasury. Obviously 7 years is too long because the $1.6b annual Treasury coupon will be reduced as FRE pays back the senior preferred. Theoretically, FRE could have used its $1.2b of current book value to pay back the Treasury this quarter. FRE starting to pay back Treasury consistently quarter after quarter should be a catalyst to revalue the prefs.

Other Ways to Fill in the Hole

1. FRE has a $33.3 billion tax asset valuation allowance. Now that FRE may be consistently profitable some of that allowance may be reversed.

2. Mark ups on trading securities.

3. Over-reserved for losses. My exercise above estimated that there are $6.5b more of provisions to take, but who knows... perhaps FRE's existing $39.6b provision is more than enough.

4. Treasury reduces the 10% coupon rate. Hey, even Ralph Nader is on my side: http://www.nader.org/index.php?/archives/2242-WSJ-Opinion-The-Great-Fannie-and-Freddie-Rip-Off.html

5. Treasury converts all or part of its senior prefs into common equity. Drinks on me if this happens.

Risks

1. Economy, employment, and housing take another header, rendering my guesses at eventual loan losses a fanciful exercise in futility.

2. The government decides to screw FRE/FMN prefs/common holders in any number of ways. The thesis works under a regime of benign neglect from Uncle Sam (letting FRE earn its way out). Politics is hard to judge, but it will be hard to nuke FRE/FNM when they are making $ for taxpayers (10% coupon), profitable, paying Uncle Sam back, and are the only mortgage game in town.

3. Anything that compresses spreads and thus reduces PPPTI: flatter yield curve, competition comes back to mortgage market.

Catalysts

1. Consistent profitability as loss provisions wind down.

2. FRE begins to pay back Treasury.

3. Treasury cuts coupon, common conversion, or something helpful to declare bailout victory. Obama can say "I hunted down Bin Laden and saved our financial system. The TARP babies, GM, Freddie, Fannie."

4. Ralph Nader wins the 2012 presidential election: http://www.nader.org/exit.php?url_id=490&entry_id=2258